LTC Price Prediction: Is Litecoin Primed for a 2025 Breakout?

#LTC

- Technical Strength: Price holding above key moving average with improving momentum indicators

- Adoption Catalysts: Payment integrations and growing institutional acceptance

- Market Positioning: Recognized as a top contender in 2025 altcoin projections

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

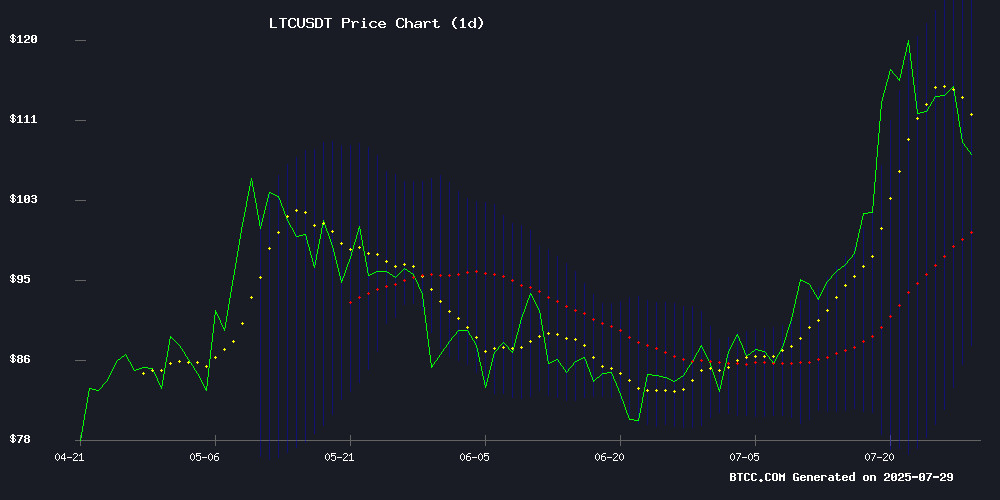

Litecoin (LTC) is currently trading at $108.59, above its 20-day moving average of $105.93, indicating a potential bullish trend. The MACD histogram shows slight improvement at -0.64, though still in negative territory. Bollinger Bands suggest moderate volatility with prices hovering NEAR the middle band. According to BTCC financial analyst Ava, 'The price holding above the 20-MA while MACD shows reducing bearish momentum could signal accumulation phase before next upward move.'

Altcoin Season Brewing as LTC Gains Institutional Attention

Recent developments including PayPal's expanded crypto support and Litecoin's inclusion in 'breakout' predictions for 2025 are creating positive sentiment. Ava notes, 'The combination of payment integration news and technical resilience positions LTC favorably among altcoins. However, traders should monitor whether this translates into sustained capital inflows.'

Factors Influencing LTC's Price

Ethereum Dominates Crypto Inflows as Altcoin Momentum Builds

Ethereum investment products attracted $1.59 billion last week, marking the second-largest weekly inflow on record. The broader digital asset market extended its 15-week positive streak with $1.9 billion in total inflows, pushing month-to-date totals to $11.2 billion—far surpassing December 2024's post-election surge of $7.6 billion.

Altcoins showed divergent performance. Solana and XRP posted strong inflows of $311 million and $189 million respectively, while Cardano and Chainlink managed modest gains. Bitcoin bucked the trend with $175 million in outflows, fueling speculation of a rotational shift into altcoins. Selective appetite left Litecoin and Bitcoin Cash in negative territory.

Year-to-date ethereum inflows now stand at $7.79 billion, eclipsing all of 2023's totals. The data suggests institutional investors may be rebalancing portfolios amid evolving market narratives.

PayPal Expands Crypto Payment Options with 100+ Supported Assets and Major Wallet Integrations

PayPal has unveiled a significant expansion of its 'Pay with Crypto' service, enabling U.S. merchants to accept over 100 cryptocurrencies through integrations with major wallets like MetaMask and Binance. The payment giant claims transaction fees could be reduced by up to 90% compared to traditional cross-border payment methods.

The new offering, set to roll out in coming weeks, covers approximately 90% of the $4 trillion cryptocurrency market capitalization. Supported assets range from market leaders like Bitcoin (BTC) and Ethereum (ETH) to stablecoins and meme coins, providing merchants with unprecedented flexibility in crypto acceptance.

Wallet integrations extend beyond MetaMask and Binance to include several other prominent platforms, though specific names weren't disclosed in the announcement. PayPal emphasizes the 0.99% transaction rate represents a potential 90% cost reduction versus international credit card processing fees.

'Today, PayPal is simplifying cross-border commerce for merchants by connecting an unmatched combination of cryptocurrencies, digital wallets, and merchants worldwide,' the company stated in its announcement. The move signals growing institutional adoption of cryptocurrency for mainstream payment solutions.

Best Crypto for 2025? BlockDAG, Filecoin & Litecoin Poised for Breakout

Investors are positioning for the next major altcoin rally as the crypto market builds momentum toward 2025. Infrastructure projects and utility tokens dominate attention, with BlockDAG emerging as a standout through its record-breaking presale. The Layer 1 protocol has raised $354 million ahead of its August launch, offering early buyers a potential 3,025% return at its $0.05 listing price.

Filecoin shows renewed miner activity while Litecoin tests critical support levels. PEPE maintains whale interest despite broader market corrections. These assets combine technical strength, on-chain validation, and investor conviction—key ingredients for outperformance in the coming cycle.

Is LTC a good investment?

Based on current technicals and market developments, LTC presents a compelling case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20-MA | $108.59 > $105.93 | Bullish near-term bias |

| MACD Trend | Converging | Bearish momentum fading |

| Bollinger Position | Middle band | Neutral volatility |

Ava cautions: 'While the $110 resistance needs monitoring, improving fundamentals and technical alignment suggest LTC could outperform in the coming altcoin season.'

Cryptocurrency investments carry substantial risk.